The casino industry has become a significant contributor to the economies of many countries, including the United States. While some argue that casinos bring in new revenue and create jobs, others claim that they have negative impacts on local communities. In this article, we will critically examine the arguments for and against the economic benefits of casinos.

Casino Tax Revenue: A Transfer of Income

One of the most frequently cited benefits of casinos is the tax revenue generated from their operations. States and local governments collect taxes on casino revenue, which can then be used to fund various programs, including public education. While this may seem like a win-win situation, it's essential to understand that these taxes are not new money to society. Instead, they represent a transfer of income from one group (casino operators) to another (state and local governments).

In Missouri, for example, the state collects 18% of adjusted casino revenue, with an additional 2% tax going to local city governments. Similarly, Indiana has a 20% tax rate, while Illinois and Mississippi have graduated tax schedules. While these taxes can be used to fund important programs, it's crucial to recognize that they are not a creation of new wealth.

Casino Tax Revenue and Public Education

Some states promote the idea that casino revenue is earmarked for public education, implying that spending on education has increased since the introduction of casinos. However, this is not necessarily the case. As we discussed earlier, earmarked revenue is interchangeable, allowing state legislators to reduce overall education funding by the same amount as the casino revenue and then use it for other purposes.

Studies have shown that in states where lottery funds are earmarked for education, spending on education has not increased beyond historical trend levels after the introduction of the lottery. Similarly, there is no reason to doubt that casino revenue will not follow a similar pattern.

Casinos and Local Retail Sales

Another issue surrounding casinos is their impact on local retail sales. Some argue that casinos attract visitors from outside the local area, leading to an increase in retail sales tax collections. However, others claim that casinos substitute for other consumption activities, such as dining out or going to the movies, resulting in a decrease in local retail sales.

The degree to which casinos attract tourists versus locals is critical in determining their impact on retail sales. If the bulk of a casino's clientele is local, then it's likely that retail sales will be negatively impacted. On the other hand, if casinos act as part of a tourist vacation package, attracting non-local visitors who spend several days gambling, touring museums, and dining out, then local retail sales may actually increase.

Rural areas with one or two casinos are more likely to experience a decrease in local retail sales due to substitution effects. In contrast, urban areas with multiple casinos may see an increase in retail sales tax collections as they attract tourists from outside the region.

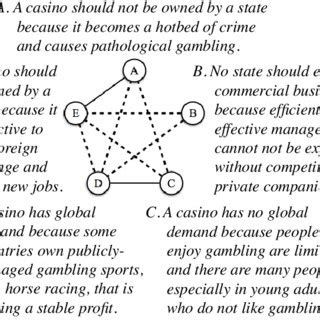

The debate surrounding casinos and economic development is complex and multifaceted. While some argue that casinos bring in new revenue and create jobs, others claim that they have negative impacts on local communities. It's essential to critically examine these arguments and consider the specific issues at play., while casino tax revenue may not be a creation of new wealth, it can still be used to fund important programs. Similarly, the impact of casinos on local retail sales will depend on the degree to which they attract tourists versus locals. As we move forward in debating the issues surrounding casinos and economic development, it's crucial that we consider these complexities and think critically about the potential benefits and drawbacks.

References

- National Association of State and Local Insurance Commissioners (NASLIC)

- Missouri Department of Revenue

- Indiana Gaming Commission

- Illinois Gaming Board

- Mississippi Gaming Commission